|

Interesting Articles about Popular Topics |

|

|

Dave Carlson - April 6, 2007 Capital outlay decisions are some of the most significant decisions a firm makes. This article discusses three types of reasons why an organization considers capital expenditures: financial (motivated by impact to the bottom line), regulatory (motivated by a desire to comply with various laws), and psychological (motivated by intangible factors). Not all decisions are determined through sound financial analysis, such as Net Present Value (NPV) or Payback methods. Sometimes government regulation forces a company, or entire industry, to make capital investment decisions. Occasionally, only the decision maker knows the criteria used to make a decision. Intangible psychological factors can influence a decision; maybe a presentation folder color. Whatever method is used, financial capital decisions have long-term impact on the organization. Capital outlay decisions are some of the most significant financial decisions an organization makes. The results of decisions about major capital projects “tangibly shape the future of a company” (Smith & Hickman, 2006, ¶ 1). Even in the most successful organizations, capital is a limited resource, so there needs to be a way to choose between competing demands for capital. Capital budgeting is concerned with purchase and maintenance of assets with a lifetime of more than a year. Many capital decisions made today can influence how an organization does business into the next decade or longer. Some capital decisions take years or decades to deliver measurable results (Smith & Hickman, 2006, ¶ 31). Some capital decisions may determine if the organization will continue to exist beyond the current budget year. The wrong decision may drive the company into bankruptcy. The right decision may propel a company to the top of its industry. Building a new factory, opening a foreign office, replacing a central air conditioning system, and installing a large Customer Resource Management computer system are all examples of capital budget items. Each organization has its own criteria for determining specific capital expenditure items, but in all cases, capital expenditures can make a significant impact on the future of an organization. A financial decision maker must decide on the best use of an organization’s assets. He is charged with making responsible decisions about which capital expenditure alternatives are in the best interest of the organization. Occasionally the best decision is to do nothing, but most of the time the organization must choose between several, sometimes dissimilar, viable alternatives. There are many factors that can prompt an organization to make a decision to pursue a capital expenditure project. This paper will discuss three types of reasons why an organization considers capital expenditures: financial, regulatory, and psychological. Financial reasons are motivated by the impact on the bottom line; evaluation of whether the capital expenditure leads to increased profits or reduction of expenses. Regulatory reasons are motivated by a desire to comply with various laws, either to remain in business or stay out of trouble. Psychological reasons are motivated by intangible factors, such as customer perceptions, owner ego, desire to support a cause, and societal pressure. This section will build on the assumption that private industry is motivated to increase its return on investment and public organizations are motivated to reduce expenses. For the purpose of these discussions, let us assume that both private industry and public organizations are interested in making the best financial decision concerning capital expenditures.

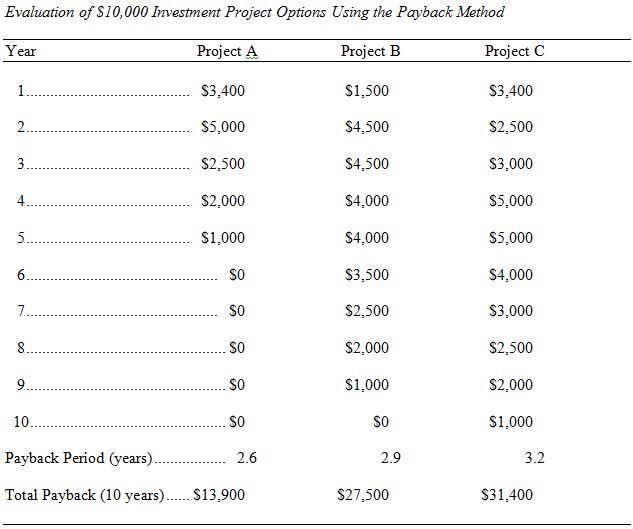

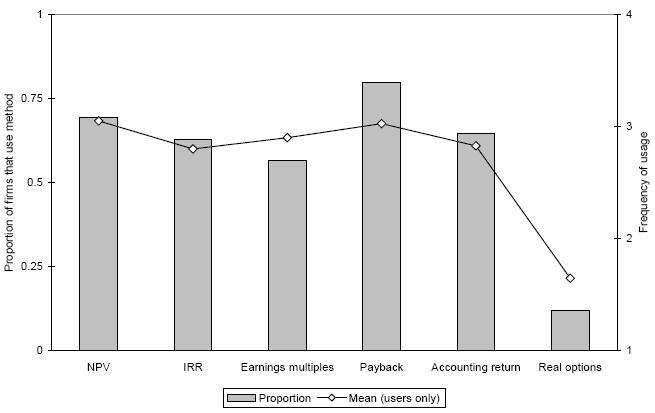

(click for larger image) Figure 1. The relative popularity of different capital budgeting methods in Sweden (Holmén & Pramborg, 2005, p. 32). There are several financial evaluation techniques available to help guide a financial decision maker toward the appropriate decision regarding capital expenditures (see Figure 1). The most popular methods are Net Present Value, Internal Rate of Return (and Modified Internal Rate of Return), and Payback. This section will discuss payback and net present value (NPV) financial evaluation methods. In a survey of Swedish business leaders, Holmén & Pramborg (2005) discovered that 79% of firms used the Payback method, while 68% relied on the Net Present Value method (p. 3). It is interesting to note that a survey of US CFOs demonstrated the opposite: 57% used the Payback method, while 76% always or almost always relied on the Net Present Value method (Holmén & Pramborg, 2005, p. 1). The numbers add up to more than 100%, because survey respondents were allowed to choose more than one answer. The respondents indicated how many times they used the various methods to make capital investment decisions. Payback MethodDecisions made using the Payback method are concerned with determining the time required to recoup the initial investment (Block & Hurt, 2008, p. 371). It is simply the number of years it takes to recover project costs (see Table 1). This method is used frequently by small business owners to show a banker the company has the ability to repay a loan. This method is easy to understand and ties cash flow directly to investment recovery.

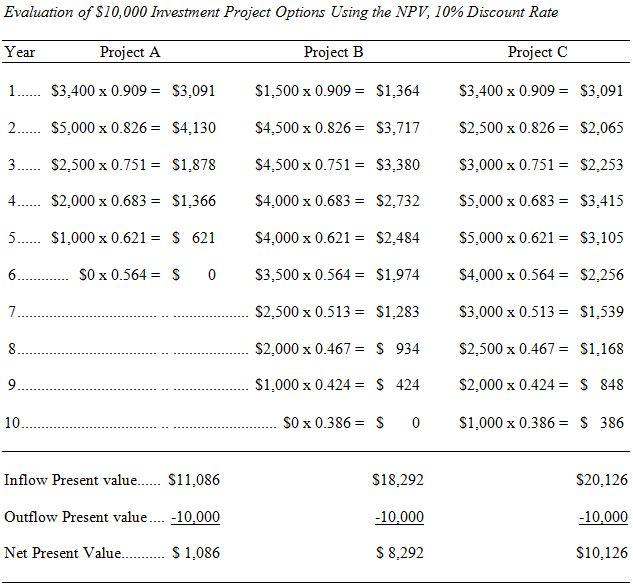

Based on the Payback method, the correct choice is Project A, since it takes the shortest amount of time (2.6 years) to recover the initial $10,000 investment. Projects B and C will be rejected, because they take longer to recover the initial investment. Table 1 illustrates the most significant flaw in the using the Payback method for determining the best investment: There is no consideration of additional income generated after the break-even point (Block & Hurt, 2008, p. 371). If the projects are evaluated for a 10-year period, Project A appears to be the least desirable choice. The Payback method also gives no consideration to the time value of money. Because this method does not account for either additional income or time value of money, most financial analysts use other methods to evaluate capital expenditures. Net Present Value (NPV) MethodThis method determines if the investment will generate a profit when compared to the value of investment capital today. The Net Present Value (NPV) method begins with the assumption that cash in hand today is worth more than the equal amount of cash available in the future. It looks at the total cash inflows and outflows of a proposal in the value of today’s dollars. NPV discounts inflows over the life of the investment. The purpose is to determine if the total investment inflow will at least equal or exceed the initial investment (Block & Hurt, 2008, p. 374). The discount rate is the cost of capital, for purposes of this discussion it is assumed to be 10%. See Appendix for a list of annual discount rates used in Table 2.

NPV evaluation indicates that Project C is the clear choice. The short-term approach taken by the Payback method pointed to Project A and a possible $9,040 loss. As illustrated in Figure 1, many analysts prefer the NPV method for evaluating capital investment decisions. The following light-hearted Analyst’s Prayer espouses the value of NPV: Give me the intellect to seek the knowable; give me peace of mind to accept the unknowable. Give me the strength to reject the investments with negative NPV and the wisdom to select the projects with positive NPV. Most importantly, give me the inspiration (preferably the correct risk-adjusted cost of capital) to know the difference between a good investment and a bad investment. (Tham & Vélez-Pareja, 2004, p.VII) On April 2, 2007 the US Supreme Court ruled that the United States Environmental Protection Agency (EPA) has the legal right to regulate motor-vehicle emissions (549 U.S. 3, 2007, p. 2). This ruling may have serious repercussions on the automobile industry, as they may be forced into capital expenditure projects to modify automobiles to reduce exhaust emissions (which have been proven to affect global warming) sooner than they would like. If the EPA yields to pressure from groups promoting the reduction of greenhouse gasses, they may issue regulations requiring the reduction of automobile exhaust emissions to a specific level by a specific date. At that point, the automotive industry will be required to plan for and make significant capital expenditures. No financial model will demonstrate that this is a good idea (other than showing the alternative is going out of business). Of course, remaining in business, paying fines, and complying with regulations all may be factored into the financial analysis of this type of capital expenditure project. Automotive manufacturers will need to evaluate increased capital expenditures, how much their customers will be willing to pay for a vehicle, the choice of technologies to pursue, and a myriad of other factors. Who and why will be specified in the EPA regulation, and the choice of if and when they will proceed will be made for them. The manufacturers will be left with the how they will proceed. Sarbanes-Oxley ActThe most significant recent finance-related regulatory act that forced some companies to make capital investment decisions is the 2002 Sarbanes-Oxley Act. The Act established a five-member Public Company Accounting Oversight Board responsible for “auditing standards within companies, controlling the quality of audits, and setting rules and standards for the independence of the auditors” (Block & Hirt, 2008, p. 11). Additionally, it increased the duties of the internal audit committee in a publicly traded company. The catalyst for the Act was the failure of Enron, Tyco, WorldCom, and other “very large and high profile companies” (Block & Hirt, 2008, p. 11). Senator Paul Sarbanes (D-MD) and Representative Michael G. Oxley (R-OH), the Act’s sponsors and main architects, suggested the Congress do something to control corrupt corporate activities. Congress agreed on July 30, 2002 when they passed The Sarbanes-Oxley Act of 2002 (Pub. L. No. 107-204, 116 Stat. 745, “also known as the Public Company Accounting Reform and Investor Protection Act of 2002 and commonly called SOx or Sarbox)” (Wikipedia, 2007, ¶ 1). The House approved the Act by a 423-3 vote (http://clerk.house.gov/evs/2002/roll348.xml) and the Senate also overwhelmingly supported the Act with a 99-0 vote (http://www.senate.gov/legislative/LIS/roll_call_lists/roll _call_vote_cfm.cfm?congress=107&session=2&vote=00192). Addison-Hewitt Associates has created a Web Site to “assist and guide” interested persons on the aspects of the Act (www.soxlaw.com). Their suggestion to affected businesses is: Perhaps the most important statement on the entire web site: don't put off until tomorrow what can be done today! With other legislation and regulation we have seen far too often organizations leave compliance until the last few days, and subsequently suffer adverse consequences. (Addison-Hewitt Associates, 2006, ¶ 10) The Sarbanes-Oxley Act, as with many laws, may just be an additional burden for most companies. Those who do not have a problem do not need government oversight. Green (2004) suggests “that a positive culture is vital to good governance and control and that the government cannot effectively legislate it” (p. 20). He further exhorts employees, managers, and company directors to ensure they do not “allow a star manager to run roughshod over our organizations” (Green, 2004, p. 20). Sometimes there are no logical or financially sound reasons for capital expenditures. Terms such as gut feeling, intuition, blind faith, or luck are the only way to explain why someone makes a decision to invest a large amount of money in a capital project. Sometimes motivational reasons remain locked in a decision maker’s brain and go with him to his grave. These reasons may even be subconscious and the decision-maker is unable to explain why he made the decision. Bannister & Remenyi (1999) categorizes this psychological phenomenon more euphemistically as strategic insight (p. 14). It really means the same thing: making a decision based on some intangible reasoning. Capital expenditures may serve as a perceived solution to an ethical dilemma as the lesser of two evils. If a CEO makes a promise to employees to build a day care facility without thoroughly working through the cost ramifications of that promise he may be forced to make a no-win decision. Here is the scenario. Building a day care center will make the employees happy and allow the CEO to keep a promise. However, the cost of the day care center will put the company in a serious financial bind. If providing a day care center for employees leads to increased productivity and increased profits, then history will look favorably on the CEO’s decision. Conversely, if the day care center never creates conditions that add to the bottom line then company may never recover financially from the cost of the day care center and go out of business. The second outcome certainly would not receive a best-practices nomination. Fairchild (2004) studied the phenomenon of managerial irrationality in capital budgeting (p. 5). This paper will discuss two theories for why managers make irrational capital budgeting decisions. The first theory, called bounded rationality, is that the manager is “incapable or unwilling to process all of the available information” (Fairchild, 2004, p. 4). The second theory, called prospect theory, is that the manager places “too much weight on low probability gambles and too little weight on high probability gambles” (Fairchild, 2004, p. 4). Bounded RationalityIt is not unusual for a capital expenditure project to be extremely complicated with a multitude of decision points and unknown variables. It could be argued that some capital projects contain an almost infinite possibility of unknown variables. Making a decision in the face of overwhelming unknown possibilities can tax the ability of even the most seasoned risk manager. The theory of Bounded Rationality was proposed originally by an American behaviorist Herbert Simon (1916-2001). It is “an analysis of decision-making which accepts that there are cognitive limits to an individual’s knowledge and capacity to act rationally” (Economy Professor, 2006, ¶ 1). Chi & Fan (1997) built on this idea with the theory that humans may have developed a way for their brains to reduce complex tasks to simple judgmental procedures for responding to situations which exceed the brain’s capacity to process the details (p. 29). Forced to make a decision in the light of such overwhelming possibilities may cause an inexperienced manager to make a completely emotional decision: he or she likes the color of the folder containing the proposal paperwork. Prospect TheoryMotivation for this kind of decision is similar to the decision to place a wager at the roulette table; then continuing to place additional wagers whether or not any spin produces a winning result. This theory is demonstrated most often when a manager recognizes that she is accountable for large loses on a project. Correct financial reasoning would not consider sunk costs (money already spent) in a decision to continue. The experienced financial analysis would look only forward to consider future value of the project (by an appropriate method discussed in the first section). However, someone making a decision based on prospect theory will not let go of the past and will consider the entire financial history of the project in a decision to proceed (Fairchild, 2004, p. 8). A decision-maker who follows the prospect theory sees only two possibilities: a known loss or a possible win. Following the prospect theory, a manager would choose to gamble with project continuation, instead of accepting the sure loss from abandoning the project (Fairchild, 2004, p. 8). It is not surprising that the manager who initiated the project (the project champion) is more likely to succumb to this activity than a manager who takes over after the project has been initiated. The manager who did not make the initial decision to go forward with the project might find it easier to abandon the project if financial analysis indicates the project should not continue (Fairchild, 2004, p. 8). Many times the decision to remain with a failing project is motivated by regret for getting involved in the first place (aptly called the regret theory). The avoidance of shame or emotional pain is such a strong motivator that the manager will convince herself that the only possible solution is success, no matter what the rational financial analysis reveals. The siren of possible future success totally overshadows the specter of guaranteed financial ruin. This can cause a manager to look only at the positive side of a decision and ignore the negative reality. “Managerial optimism can result in all kinds of flawed and risky decisions” (Teach, 2004, ¶ 18). Sometimes a positive mental attitude is not a good thing. Not all capital investment decisions are determined through sound financial analysis. Sometimes government regulation forces a company, or entire industry, to make capital investment decisions. Occasionally, only the decision maker knows the criteria used to make a decision based on intangible psychological factors. Whatever evaluation methods or intangible conditions influence capital budgets the bottom line is: Capital outlay decisions are some of the most significant financial decisions an organization makes. Addison-Hewitt Associates. (2006). A guide to the Sarbanes-Oxley Act. Retrieved April 3, 2007 from http://www.soxlaw.com/ Bannister, F. and Remenyi, D. (1999). Instinct and value in IT investment decisions. [Electronic version]. Shropshire, UK: Management Research Centre Wolverhampton Business School. Block, B. B. and Hirt, G. A. (2008). Foundations of financial management (12th ed). New York: McGraw-Hill. Chi, T. and Fan, D. (1997, Winter). Cognitive limitations and investment myopia. Decision Sciences Journal, 28(1), 27-58. Economy Professor. (2006). Bounded rationality. Retrieved April 5, 2007 from http://www.economyprofessor.com/economictheories/bounded-rationality.php Fairchild, R. (2004). Behavioral finance in a principal-agent model of capital budgeting. University of Bath School of Management Working Paper Series. Green, S. (2004). Manager’s guide to the Sarbanes-Oxley Act: Improving internal controls to prevent fraud. Hoboken, NJ: Wiley. Holmén, M. and Pramborg, B. (2005). Capital budgeting and political risk: Empirical evidence. [Electronic version]. Unpublished paper. Retrieved April 3, 2007 from http://www.nek.uu.se/StaffPages/Publ/P547.pdf Massachusetts et al. v. Environmental Protection Agency et al., 549 U.S. 3 (2007). Smith, J. and Hickman, A. Y. (2006). Capital decisions: Educating executives. Chief Learning Officer: Solutions for enterprise productivity. Retrieved April 6, 2007 from http://clomedia.com/content/templates/clo_article.asp?articleid=1606&zoneid=59 Teach, E. (2004, June). Avoiding decision traps: Cognitive biases and mental shortcuts can lead managers into costly errors of judgment. CFO Magazine. Retrieved April 3, 2007 from http://www.cfo.com/article.cfm/3014027/c_3046613?f=singlepage Tham, J. and Vélez-Pareja, I. (2004). Principles of cash flow valuation: An integrated market based approach. Burlington, MA: Elsevier Academic Press. Wikipedia. (2007). Sarbanes-Oxley Act. Retrieved April 3, 2007 from http://en.wikipedia.org/wiki/Sarbanes-Oxley_Act |

||||||||

|